Samsung Electronics Co., the world‘s top smartphone maker, said Thursday its third-quarter profit fell to the lowest in three years on waning sales of flagship smartphones, as it faces challenges ahead in competing with smaller Chinese startups and long-time rival Apple Inc.

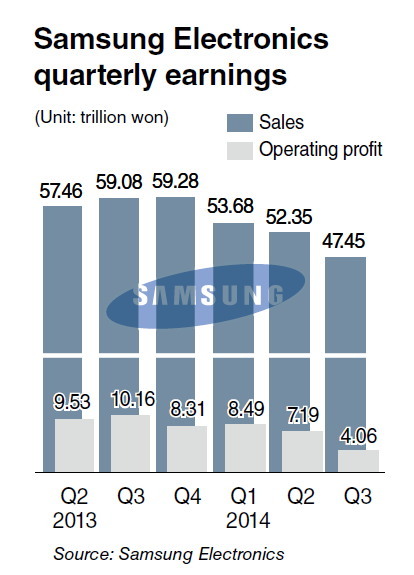

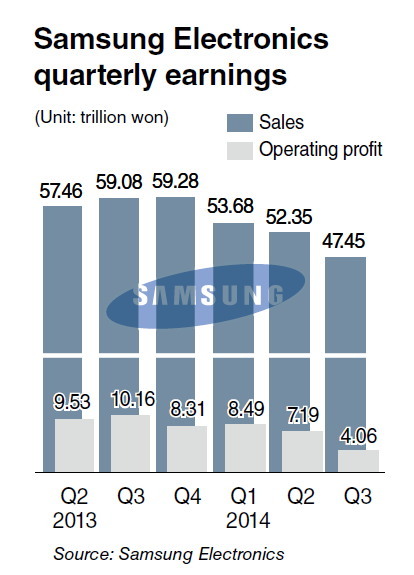

Net profit reached 4.22 trillion won ($4.01 billion) in the July-September period, down 48.7 percent from 8.24 trillion won the previous year, the company said in a regulatory filing.

Operating profit plunged 60 percent on-year to 4.1 trillion won, from a record high of 10.1 trillion won in the same quarter of 2013.

Both the net and operating profit mark the lowest in three years for the Suwon-based company, since it logged 4.02 trillion won and 3.75 trillion won in the fourth and second quarter of 2011, respectively.

The net profit also represents a fourth consecutive quarterly decline, with the operating profit having slid for two straight quarters.

Sales came to 47.4 trillion won in the third quarter, down 19.6 percent from a year earlier.

The figures were in line with Samsung’s earnings preview released earlier this month.

The weaker bottom line was attributed to a downturn in its mainstay smartphone sector, Samsung said in its earnings release.

“The new lineups such as the Galaxy Note series failed to get enough market demand, while the average selling price of older models fell.”

The operating profit in the IT mobile sector plummeted to 1.75 trillion won in the third quarter from 6.7 trillion won a year ago.

Samsung smartphones have been losing competitiveness, squeezed by Apple Inc.’s high-end iPhone 6 and cheaper products made by Chinese players like Lenovo.

The fast growth of Xiaomi Inc. has become a threat to the Korean giant as the Beijing-based tech startup has aggressively expanded its market presence to currently the third largest in the world’s most populous country.

The release of the larger iPhone 6 quickened the hard landing for Samsung‘s earnings.

Robert Yi, head of investor relations at Samsung, admitted that the company may have failed to “react swiftly to the change in the global price war between mobile phone makers.”

“Uncertainties remain as to whether the mobile sector will recover since competition is getting fiercer with rising marketing costs,” he said via a conference call following the earnings release.

Analysts here agreed with his remark.

“Samsung may have overlooked Chinese players. Not many thought they would grow this fast. (Samsung) was too confident about its brand value,” said Kim Young-chan, an analyst at Shinhan Investment Corp.

Samsung will have to go with a two-track strategy ― keeping premium lineups to vie with Apple, while making cheaper phones to compete against Chinese rivals ― to stave off a further slowdown, Kim added.

The tech giant announced this week it plans to launch the Galaxy A series, mid-to-low handsets, in China early November.

Its consumer electronics division posted operating profit of 50 billion won, compared with 350 billion won the previous year. The company cited the absence of a one-off factor since the World Cup and rising panel prices.

But sales of premium ultrahigh-definition TVs gained 24 percent from three months earlier on robust demand from China, Samsung added. It didn’t disclose comparable on-year figures.

Samsung’s display and panel part business remained sluggish due to weak sales in organic light-emitting diode, although shipments of liquid crystal displays increased on the back of higher panel prices.

The memory chip division suffered the lightest blow, propped up by firm seasonal demand for DRAMs and NAND flash chips, Samsung said.

It logged 2.33 trillion won in operating profit, down from 3.09 trillion won a year earlier.

Analysts shared the view that Samsung has most likely bottomed out in the third quarter, carefully predicting better fourth-quarter results as a pickup in demand for displays and memory chips may fuel stable growth.

“We expect a moderate on-quarter rise in Galaxy sales. Samsung has many (smartphone) lineups that Koreans don’t know about, such as those mid-to-low ones being sold in China and India,” said Kim of Shinhan Investment.

The world‘s top smartphone maker is estimated to post 5.42 trillion won for its fourth-quarter operating profit, down 34 percent from 8.31 trillion won a year ago, according to data compiled by market tracker FnGuide Inc., based on a survey of 27 brokerage houses here. (Yonhap)

Net profit reached 4.22 trillion won ($4.01 billion) in the July-September period, down 48.7 percent from 8.24 trillion won the previous year, the company said in a regulatory filing.

Operating profit plunged 60 percent on-year to 4.1 trillion won, from a record high of 10.1 trillion won in the same quarter of 2013.

Both the net and operating profit mark the lowest in three years for the Suwon-based company, since it logged 4.02 trillion won and 3.75 trillion won in the fourth and second quarter of 2011, respectively.

The net profit also represents a fourth consecutive quarterly decline, with the operating profit having slid for two straight quarters.

Sales came to 47.4 trillion won in the third quarter, down 19.6 percent from a year earlier.

The figures were in line with Samsung’s earnings preview released earlier this month.

The weaker bottom line was attributed to a downturn in its mainstay smartphone sector, Samsung said in its earnings release.

“The new lineups such as the Galaxy Note series failed to get enough market demand, while the average selling price of older models fell.”

The operating profit in the IT mobile sector plummeted to 1.75 trillion won in the third quarter from 6.7 trillion won a year ago.

Samsung smartphones have been losing competitiveness, squeezed by Apple Inc.’s high-end iPhone 6 and cheaper products made by Chinese players like Lenovo.

The fast growth of Xiaomi Inc. has become a threat to the Korean giant as the Beijing-based tech startup has aggressively expanded its market presence to currently the third largest in the world’s most populous country.

The release of the larger iPhone 6 quickened the hard landing for Samsung‘s earnings.

Robert Yi, head of investor relations at Samsung, admitted that the company may have failed to “react swiftly to the change in the global price war between mobile phone makers.”

“Uncertainties remain as to whether the mobile sector will recover since competition is getting fiercer with rising marketing costs,” he said via a conference call following the earnings release.

Analysts here agreed with his remark.

“Samsung may have overlooked Chinese players. Not many thought they would grow this fast. (Samsung) was too confident about its brand value,” said Kim Young-chan, an analyst at Shinhan Investment Corp.

Samsung will have to go with a two-track strategy ― keeping premium lineups to vie with Apple, while making cheaper phones to compete against Chinese rivals ― to stave off a further slowdown, Kim added.

The tech giant announced this week it plans to launch the Galaxy A series, mid-to-low handsets, in China early November.

Its consumer electronics division posted operating profit of 50 billion won, compared with 350 billion won the previous year. The company cited the absence of a one-off factor since the World Cup and rising panel prices.

But sales of premium ultrahigh-definition TVs gained 24 percent from three months earlier on robust demand from China, Samsung added. It didn’t disclose comparable on-year figures.

Samsung’s display and panel part business remained sluggish due to weak sales in organic light-emitting diode, although shipments of liquid crystal displays increased on the back of higher panel prices.

The memory chip division suffered the lightest blow, propped up by firm seasonal demand for DRAMs and NAND flash chips, Samsung said.

It logged 2.33 trillion won in operating profit, down from 3.09 trillion won a year earlier.

Analysts shared the view that Samsung has most likely bottomed out in the third quarter, carefully predicting better fourth-quarter results as a pickup in demand for displays and memory chips may fuel stable growth.

“We expect a moderate on-quarter rise in Galaxy sales. Samsung has many (smartphone) lineups that Koreans don’t know about, such as those mid-to-low ones being sold in China and India,” said Kim of Shinhan Investment.

The world‘s top smartphone maker is estimated to post 5.42 trillion won for its fourth-quarter operating profit, down 34 percent from 8.31 trillion won a year ago, according to data compiled by market tracker FnGuide Inc., based on a survey of 27 brokerage houses here. (Yonhap)

-

Articles by Korea Herald

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)