[News Focus] Korea’s household debt-to-income to top 200%

By Kim Yon-sePublished : June 16, 2019 - 15:42

SEJONG -- The record household debt in South Korea is an Achilles’ heel when it comes to economic growth, as the financial liability of citizens is putting a damper on private consumption.

Some market analysts say that Korea’s collective household debt is estimated to have topped 2,000 trillion won ($1.68 trillion). They claim the latest figure of about 1,500 trillion won, released by the Bank of Korea, does not include loans extended to the self-employed.

In any case, the outstanding loans issued to the household sector have reached an all-time high over the past few decades since the central bank and the Financial Supervisory Service started compiling related data.

Some market analysts say that Korea’s collective household debt is estimated to have topped 2,000 trillion won ($1.68 trillion). They claim the latest figure of about 1,500 trillion won, released by the Bank of Korea, does not include loans extended to the self-employed.

In any case, the outstanding loans issued to the household sector have reached an all-time high over the past few decades since the central bank and the Financial Supervisory Service started compiling related data.

In the early 2000s, the nation had to count the cost of recklessly doling out credit cards, yielding a large number of defaulters. At that time, some issuers provided people who applied for new cards cash incentives immediately as promotion. Many cardholders were saddled with unbearable debt after actively using cash advance services and card loans.

Still, many cardholders are reportedly resorting to cash advances or the so-called revolving settlement, in which they pay their dues with other issuers’ cards.

“The government and the BOK have a social obligation not to see a repetition of the 2003 credit card fiasco,” said a research analyst in Seoul. “More seriously, households have increased their borrowings from second-tier financial firms.”

The second-tier financiers include savings banks and capital services firms, both of which levy quite higher interest rates, compared to commercial banks.

Ordinary customers of the secondary financial firms hold low credit scores and their income level is not high, which is worrisome regarding possible delinquency, the analyst said.

Further, most people share the view that mortgage loans, issued to a large number of households since 2014, is the hefty downside of the national economy.

The previous Park Geun-hye administration induced more households to purchase apartments by offering easy loan terms between 2014 and 2016. The Finance Ministry led the initiative in mortgage deregulations, and the BOK continually cut the benchmark interest rate.

Despite this risky situation, some government officials under the current Moon Jae-in administration are raising the necessity of further monetary easing, citing weak consumption and low economic growth.

There are online rumors that the Moon administration would have no choice but to boost the sluggish economy via the real estate sector. They say feasibility of easing mortgage rules again or active approval of rebuilding of old apartment complexes in southern Seoul is possible.

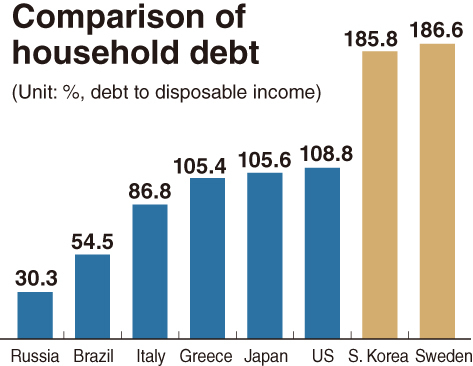

Meanwhile, a global comparison indicates the seriousness of household debt in Korea.

According to the national accounts statistics of the Organization for Economic Cooperation and Development, Koreans hold excessive consumer debt compared to their cashable assets.

Korea saw the ratio of household debt to net disposable income come to 185.88 percent at the end of 2017, ranking seventh in terms of risks among the 35 members researched -- excluding Mexico.

Its level is more critical compared to Ireland with 153.2 percent, the UK with 148.8 percent, Portugal with 131.6 percent, Spain with 116.2 percent, the US with 108.8 percent, Japan with 105.6 percent and Greece with 105.4 percent.

Among the countries that posted a ratio under 100 percent -- that means relatively decent financial soundness in their household sector -- are Italy at 86.8 percent, Estonia (80.1), Slovak Republic (78.4), Chile with (66.7), Poland (62.0), Slovenia (56.7), Brazil (54.5), Colombia (45.7), Hungary (43.2) and Russia (30.3).

Only six countries posted higher that Korea in the ratio. Nonetheless, the six -- Sweden, Switzerland, Australia, Norway, the Netherlands and Denmark -- were higher than Korea in per capita national income and secure better social welfare backed by their governments.

The debt-to-income ratio of households in Korea grew rapidly over the past few years and is heading toward the 200 percent mark -- meaning debt doubles their disposable income -- after topping 150 percent in 2010 and 180 percent in 2016.

A professor in Seoul advised that it is not time for the nation to further slash the key interest rate but more important to induce a soft-landing of household debt via rate hikes on a gradual basis.

By Kim Yon-se (kys@heraldcorp.com)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[Graphic News] French bulldog most popular breed in US, Maltese most popular in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050864_0.gif&u=)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)