[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs

By Moon Joon-hyunPublished : April 18, 2024 - 14:59

Traditionally dominated by Japanese manufacturers like Toyota and Honda, the hybrid vehicle sector is now seeing renewed interest from global automakers looking to improve profitability amid delayed growth of pure electric vehicle sales.

Among them, Hyundai Motor Group stands out as one of the few key competitors with robust full hybrid electric vehicle technology. This positions Hyundai uniquely as one of the few automakers to profit from increasing hybrid sales as it navigates the transitional period towards more accessible EVs, anticipated to come in 2025 to 2026.

Changing lanes from ‘pure electric’ to ‘with hybrid’

“This shift from focusing solely on the future of pure battery electric vehicles to including hybrids is increasingly apparent across the industry. Giants like GM and Ford are recalibrating their strategies,” said Jo Hee-seung, an automotive and automotive parts researcher from Hi Investment & Securities. GM, for instance, planned to launch the Equinox and Sierra as electric-only models but has recently expanded to include plug-in hybrids in its lineup. Ford is reshaping its iconic F-150 line to feature hybrids and has committed to increasing its hybrid production fourfold in the next five years.

This realignment is driven by several factors. A sluggish global economy and rising oil prices have heightened consumer interest in hybrids, known for their fuel efficiency. Additionally, the slow uptake of electric vehicles is pushing car manufacturers to broaden their environmentally friendly options to comply with stricter emissions regulations.

Few excel in full hybrid systems

To respond to stricter environmental regulations, GM, Volkswagen and Mercedes Benz are offering plug-in hybrids, or PHEVs. PHEVs have lower technical barriers to entry than full hybrids because they rely more on their electric drivetrains for power and can use simpler and smaller internal combustion engines. But they could be less profitable for manufacturers than full hybrids, as they necessitate larger and costlier battery packs, raising production costs without being able to command higher market prices.

"Plug-in hybrids, which are generally simpler to develop, seem to be filling a temporary role as we transition to fully electric vehicles, especially with the current tepid demand for EVs. It might have been more financially sensible for automakers without any full hybrid tech to focus exclusively on an all-electric platform from the start," said Hwang Sung-ho, the vice president of the Korean Society of Automotive Engineers and a mechanical engineering professor at Sungkyunkwan University.

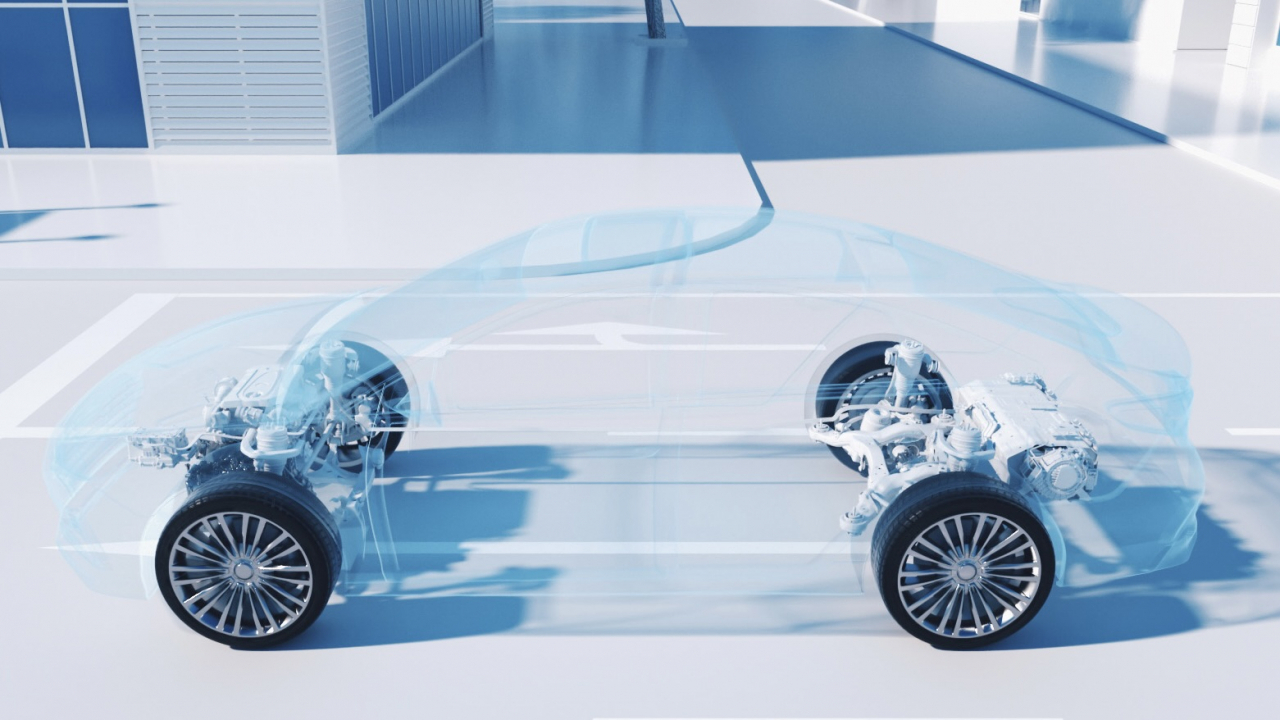

A full hybrid vehicle system efficiently alternates between the electric motor and gasoline engine to maximize fuel efficiency. In other words, a full hybrid car can run on just the engine, just the battery, or a combination of both. This offers greater flexibility that eliminates the need for external charging and can extend driving range and reduce gas station visits compared to plug-in hybrids.

Hyundai is one of the few, along with Toyota, Honda, Renault, and Ford, that has developed its own full hybrid technology. Competing with Toyota, a pioneer and dominant leader in the hybrid vehicle market known for its advanced dual-motor systems, Hyundai has been perfecting a single-motor setup for its full hybrid system.

"Even though Toyota has long been the go-to name in hybrids, thanks to the Prius, Hyundai has really stepped up its game. Its technology now stands as a serious contender, offering a solid alternative in the full hybrid market that can go toe-to-toe with Toyota," said professor Hwang.

In the first quarter of this year, Ford's sales included 7.3 percent full hybrids. In contrast, Hyundai-Kia's hybrids comprised 21 percent of their global sales in the third quarter of last year, more than doubling from 9 percent in the same period in 2020.

Shared drivetrains and depreciation tactics optimize hybrid profitability

Hyundai’s hybrid models, such as the Tucson and Santa Fe hybrid trims, are priced about 20 percent higher than their internal combustion engine counterparts due to the additional costs of hybrid-specific components like batteries and advanced transmission systems. Despite these higher material costs, simply selling hybrids at a premium doesn't inherently boost profit margins because of the significant investment required in developing these new technologies.

The handling of depreciation expenses is a significant factor in managing costs and enhancing profitability in the automotive industry.

"For Hyundai, the cost-maximizing strategy is all about spreading out the cost of developing new technologies -- such as the Gamma 1.6 turbo hybrid system introduced in 2020, used in models like the Tucson, Santa Fe and Carnival minivan -- over their useful life, typically a three-year period," explained researcher Jo.

Since these vehicles' hybrid powertrains are adaptations of existing ICE designs, the additional investment required for hybrids is relatively modest. This combination of high sales volumes and shared development costs decreases overall depreciation expense per vehicle.

By last year, Hyundai had already seen the end of the depreciation period for the hybrid systems released in 2020 and 2021. This marked a crucial turning point, significantly boosting profit margins by reducing the burden of these initial fixed costs.

To capitalize on this growing demand, Hyundai is set to increase its hybrid production from 370,000 units in 2023 to 480,000 units in 2024. Looking forward, Hyundai's focus on hybrids is expected to continue to pay off. Plans are underway to introduce new hybrid models equipped with advanced 2.5 turbo engines, starting with next year's Palisade.

“While these new models will initially increase depreciation costs due to their new technology, the longer-term outlook is promising. As these hybrids become more integrated across Hyundai's lineup, potentially including in the luxury Genesis brand, the company can replicate its current financial benefits across a wider range of vehicles, at least until around 2026 when EVs are finally expected to reach mass adoption,” said researcher Jo.

![[Herald Interview] Mom’s Touch seeks to replicate success in Japan](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/29/20240429050568_0.jpg&u=)

![[News Focus] Lee tells Yoon that he has governed without political dialogue](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/29/20240429050696_0.jpg&u=20240429210658)

![[Today’s K-pop] Seventeen sets sales record with best-of album](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/30/20240430050818_0.jpg&u=)